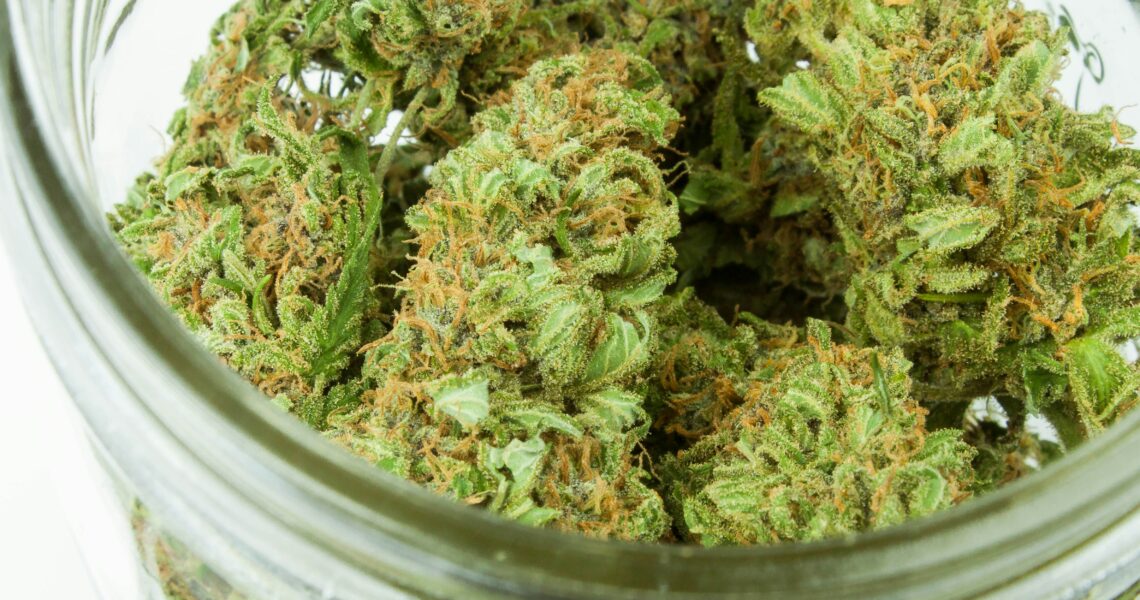

Recognizing THCA

THCA, or tetrahydrocannabinolic Acid, is a non-intoxicating cannabinoid discovered in raw cannabis plants. When warmed, THCA embarks on decarboxylation, changing right into THC, the psychedelic substance in charge of the “high” related to cannabis. However, best thca flowers itself shows off a variety of prospective health and wellness advantages, containing anti-inflammatory, neuroprotective, and antiemetic residential or industrial buildings, making it an in-demand part of medical cannabis things.

Uncovering The Most Effective THCA Flowers

Blue Need:

Blue Desire, a crossbreed anxiety renowned for its well-balanced impacts, provides a unified mix of leisure and bliss. With raised degrees of THCA, it’s prized for its potential to ease signs and symptoms of tension, anxiety, and pain while advertising creative thinking and mental clarity.

Girl Forerunner Cookies:

A precious standard amongst cannabis lovers, Woman Scout Cookies gives a potent strike of THCA along with its special, positive, and natural preferences. This Indica-dominant crossbreed is valued for its ability to cause deep leisure, making it optimal for evening use or relaxing after a long day.

Sour Diesel:

Acknowledged for its uplifting and stimulating impacts, Sour Diesel is a Sativa-dominant pressure that shows off high degrees of THCA. Its stimulating buildings make it a favored among those looking for a remedy for exhaustion, stress, and anxiousness, while its distinctive diesel-like aroma adds to its tourist attraction.

OG Kush:

An epic strain in the marijuana world, OG Kush is commemorated for its potent THCA material and signature natural, ache fragrance. With its powerful, enjoyable influences, OG Kush is frequently suggested for dealing with chronic discomfort, resting conditions, stress and anxiety, and anxiety and providing a feeling of calmness and peace.

White Widow:

Treasured for its wintry appearance and powerful THCA levels, White Widow is a crossbreed stress that supplies a well-balanced mix of bliss and recreation. Extensively appreciated for its stress-relieving homes, White Widow uses a mild yet efficient approach to chill out and discover a break from the stress and anxiety of day-to-day life.

Choosing the Right THCA Flower

Consider efficiency, terpene profile, and desired impacts when picking the most effective THCA blossom for your needs. Trial and error might be required to situate the excellent anxiety that reverberates with your preferences and wellness objectives. Furthermore, sourcing items from trusted dispensaries or qualified cultivators guarantees premium security.

Choosing the very best THCA Flowers

When choosing THCA flowers, several facets become part of the play, including cannabinoid material, terpene account, and complete high quality. Below are some vital variables to take into consideration to bear in mind:

Cannabinoid Account: Try to find flowers with high degrees of THCA to utilize the restorative possible finest. Third-party lab screening can offer an important understanding of the cannabinoid web material of a certain pressure.

Terpene Range: Terpenes are fragrant substances found in marijuana that contribute to its unique aroma and taste. Look for flowers with a different terpene for a multi-dimensional sensory experience.

Farming Practices: Choose flowers expanded using natural and lasting approaches. Accountable farmers prioritize quality and ecological stewardship, producing an outstanding final product.

Individual Reviews: Concentrate on comments from other consumers to determine the efficacy and general experience of a particular tension. Private preferences and comments can differ; however, examinations can use beneficial understandings.

Elements to Take Into Account When Picking THCA Flowers

Selecting the best THCA flowers entails thinking about several crucial aspects to guarantee optimum top quality and efficiency:

Pressure Selection: Different cannabis pressures consist of differing degrees of THCA and different other cannabinoids, each with its special scent, taste, and influence. Some pressure may be uplifting and stimulating, while others are a lot more stress-free and sedating. Comprehending your preferred outcome can help narrow the option to stress the finest matched to your requirements.

Growing Practices: The farming methods used can drastically influence the top quality of THCA flowers. Organic expansion strategies without using man-made chemicals and plant foods are generally favored for their ability to create cleaner, far more effective cannabis.

Laboratory Testing: Reliable manufacturers typically carry out total laboratory screening to ensure the stamina and pureness of their things. Search for THCA flowers that have actually been checked out for cannabinoid material, terpene account, and the absence of toxins like heavy metals and chemicals.

Aroma and Flavor: The aroma and taste of THCA flowers can vary widely depending on the stress and anxiety of terpene account. Some may have citrusy and fruity notes, while others display earthy or blossom touches. Considering various fragrances and preferences can improve the overall experience of consuming THCA flowers.

Including THCA Flowers into Your Health Routine

When choosing the best THCA flowers for your demands, including them in your health program can be a gratifying experience. Right here are some suggestions for optimizing their benefits:

Begin Low and Go Slow: If you’re new to consuming THCA flowers, start with a lowered dose and progressively improve as needed. This allows you to establish your resistance and sensitivity to the outcomes.

Checking Out Numerous Intake Methods: THCA flowers can be eaten in various ways, including smoking cigarettes, vaporizing, and including them in edibles or casts. Trying out different approaches can help you find the most suitable and satisfying choice for you.

Couple with Numerous Other Health Practices: Improve the effects of THCA flowers by incorporating them right into a holistic wellness regimen. This could include mindfulness representation, yoga workouts, or aromatherapy to promote recreation and general health.

Display Impacts and Adjust as Needed: Remember exactly how your body reacts to THCA flowers and readjust your intake appropriately. Every person’s endocannabinoid system is unique, so what works well for one person may not function well for another.

Conclusion

As we browse through the complex globe of cannabis, THCA flowers emerge as beaming indications of toughness and capacity. From the relaxing midsts of Blue Dream to the stimulating elevations of Sour Diesel, each strain provides a unique plan of outcomes, inviting exploration and discovery. With conscious elements to consider and a daring spirit, you can open the complete spectrum of advantages these excellent flowers of toughness require to use.